Share via:

THE clock is now ticking to get annual tax returns in before the 31 October deadline.

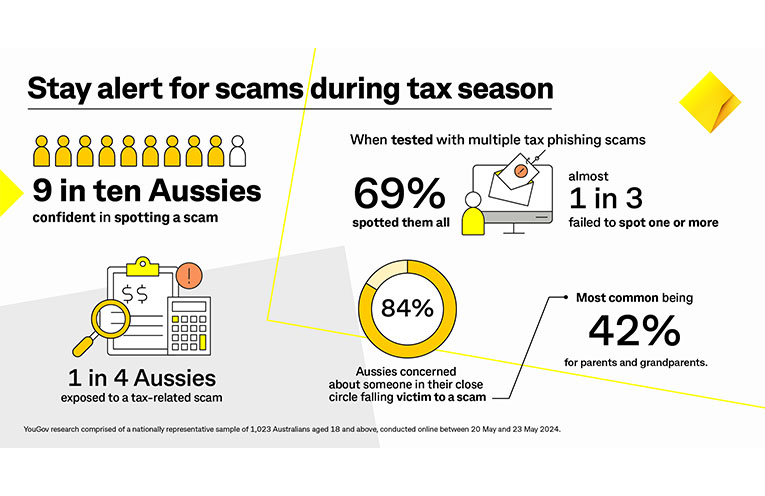

Sadly, this window provides a veritable hunting ground for scammers, prompting warnings from the Australian Taxation Office (ATO), financial institutions, and the Australian Competition and Consumer Commission (ACCC).

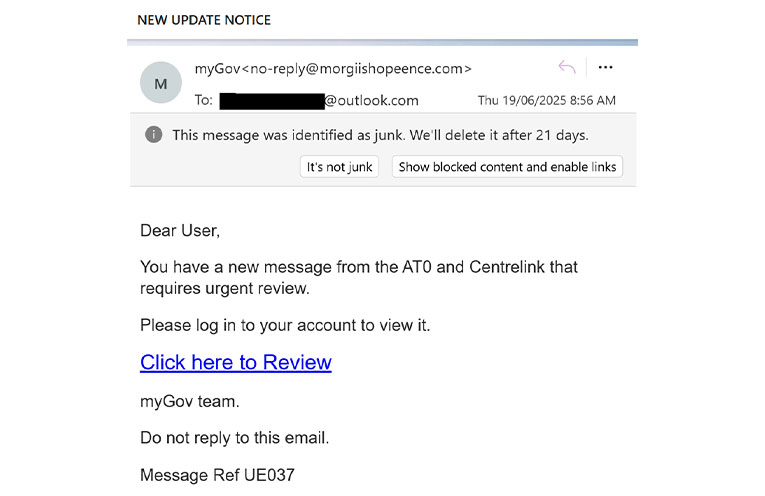

The ATO has previously warned of “impersonation scams”, which are messages pretending to be from either myGov or the ATO that falsely claim a person’s taxable income has been recalculated and they are due to receive compensation.

To claim the amount, they are asked to reply to an email or SMS, with identifying information such as payslips, their tax file number (TFN), driver’s licence and Medicare details.

“If someone claiming to be from the ATO contacts you and advises that you have a debt or are owed a refund or asks for your myGov sign-in credentials, bank or personal details such as your TFN, it is likely they are a scammer,” the ATO warns.

As of last year, the ATO has removed all hyperlinks from its unsolicited messages.

“Don’t click on links, open attachments or download any files from suspicious emails or SMS; we will never send an unsolicited SMS that contains a hyperlink.

“Know your tax affairs – legitimate email communication from us can be located in ATO online services.

“You can check this by logging into your myGov account – you can also contact your tax agent or the ATO.”

While the ATO is on Facebook, Instagram, X and LinkedIn, the organisation will never use these social media platforms to discuss personal information or documentation, or ask for payments.

Scammers are criminals who primarily prey upon the unsuspecting, the unobservant, and the vulnerable.

Their modus operandi never change and include:

1. Creating a sense of urgency about a vague yet serious problem that needs attention, as soon as possible (ASAP)

2. Providing a convenient, quick and easy solution in the form of a “just click here” button or hyperlink

3. Going to great lengths to look bona-fide, even copying the logos, layout and colour schemes of real messages.

The major banks and the ATO have made information and advice readily available, so customers and taxpayers can go straight to the source.

At the end of the day, it is up to the individual to make the right call, with the simplest solution being “if in doubt, don’t do it.”

For examples and more information about identifying and reporting scams, go to ato.gov.au/online-services/scams-cyber-safety-and-identity-protection/scam-alerts.

By Thomas O’KEEFE

You can help your local paper.

Make a small once-off, or (if you can) a regular donation.

We are an independent family owned business and our newspapers are free to collect and our news stories are free online.

Help support us into the future.

Share via: